Subsequent Tax Payments

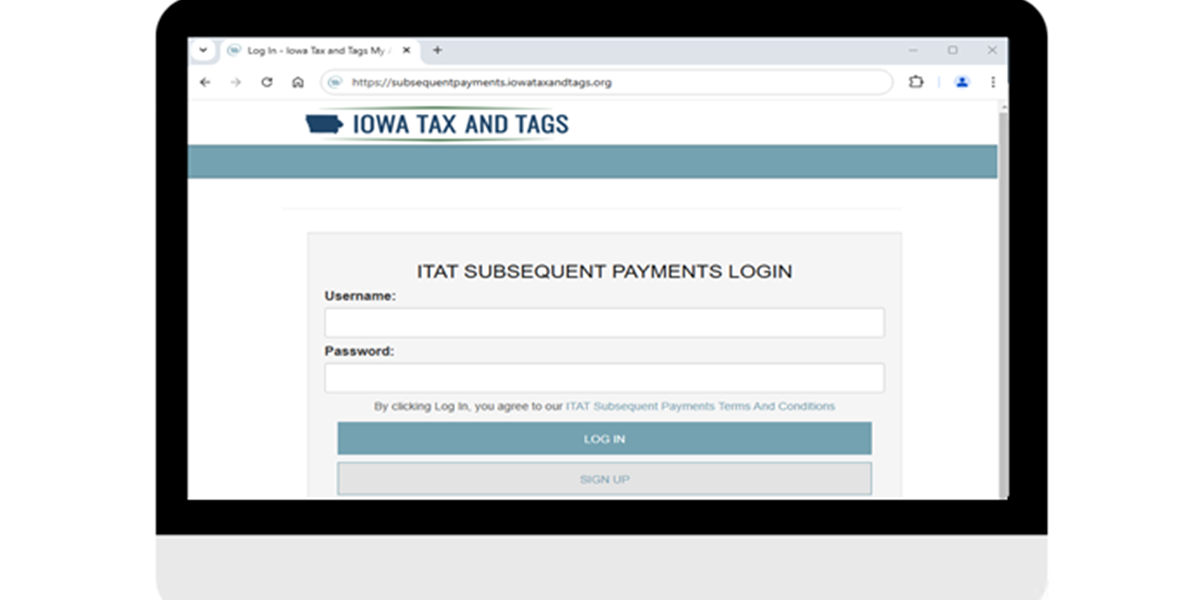

ONLINE SUBEQUENT TAX PAYMENTS

Paying subsequent tax payments online has never been easier. Sign-up for a user account today and enjoy the convenience of online subsequent tax payments.

WHO CAN MAKE A SUBSEQUENT TAX PAYMENT?

Tax Sale buyers who hold an active tax sale certificate are eligible to make a subsequent tax payments when:

- subsequent year taxes and special assessments are not paid, and

- one month and fourteen days have lapsed since the installment has become delinquent

Online subsequent tax payments on eligible parcels can be made on SubsequentPayments.IowaTaxAndTags.org for parcels located in the following Iowa counties: Buchanan, Dickinson, Floyd, Iowa, Johnson, Linn, Montgomery, Polk, or Poweshiek County

HOW DOES ONLINE SUBSEQUENT TAX PAYMENTS WORK?

Paying subsequent tax payments has never been easier. Simply create a free user account, upload a list of your bidder data, and then select and make subsequent payments for eligible parcels.

Create an account – Sign up for a free online user account. Accounts are simple to create and allows you 24/7 access to your bidder information and payment history.

Upload bidder data – Adding active tax identification numbers to your account allows you to access the parcel information for parcels that you hold active tax sale certificates on. Tax amounts are updated nightly which gives you a more accurate list of parcels with eligible balances.

Pay your taxes – Search by county for parcels with tax balances that are eligible to be paid as subsequent tax payments. Select the tax bills you want to pay and checkout using our save and secure online payment portal.

The amount of the subsequent tax payment is added to your tax sale, with interest accruing monthly, until the tax sale certificate is redeemed by the property owner.

Reminder: Subsequent Taxes are not payable until 45-days after the original delinquent date.

Sign-Up Now